Credit Benchmark have released the June Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The June CCIs have seen credit deterioration across the board.

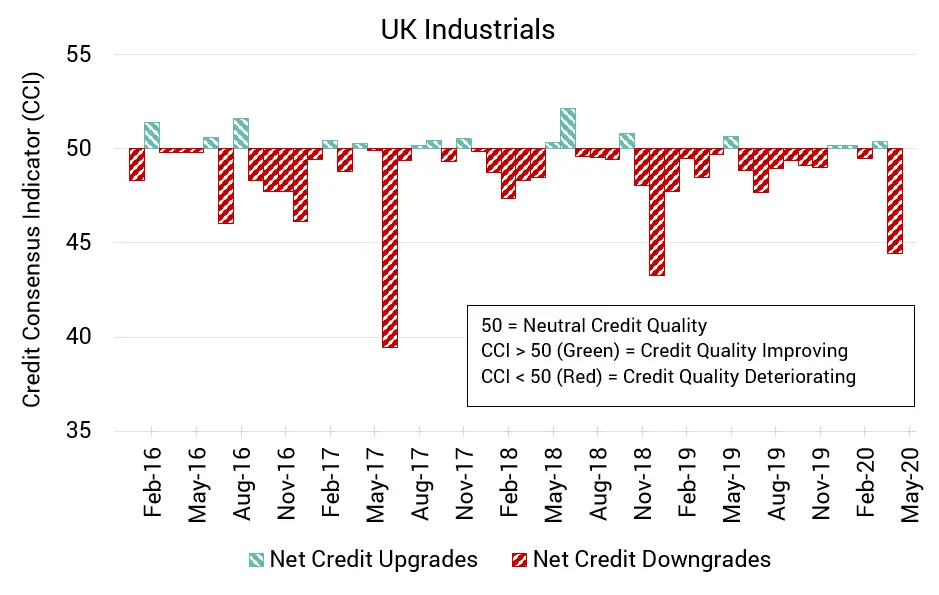

The UK Industrials CCI for June is 44.4; CCI Falls Foul of COVID Impact

The moderate trend that saw UK Industrial companies hovering near neutral for several consecutive months has come to an end, with a significant swing towards net deterioration this month.

The CCI for this month is 44.4; A large drop from last month’s just-above-neutral CCI of 50.4.

With car manufacturing in Britain dropping by 99.7% in April (compared to April 2019) and total manufacturing output dropping by 24.3% month-on-month, Covid has well and truly infected the UK industrial sector.

.

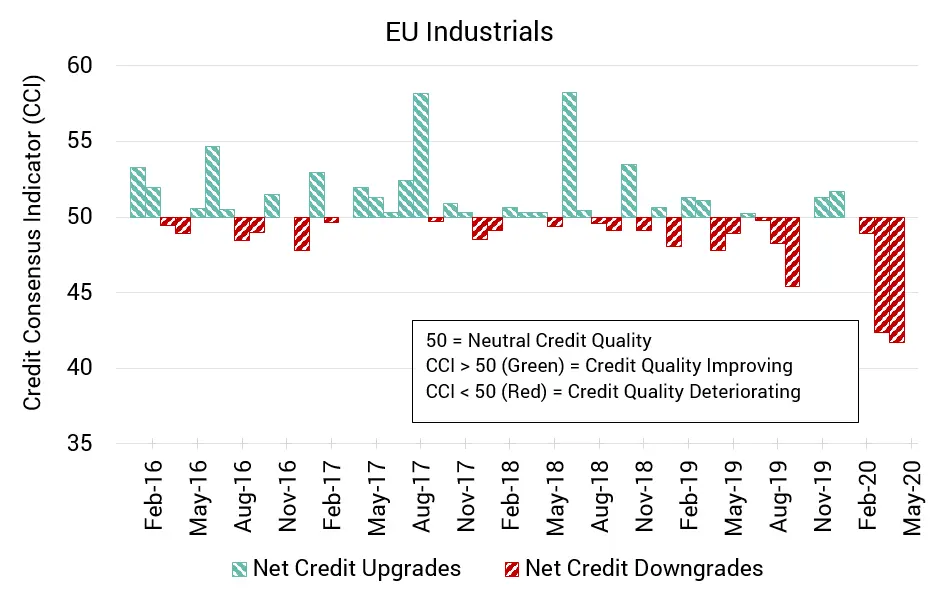

EU Industrials: Strong Bias Towards Deterioration Persists

EU Industrials have seen further deterioration this month following last month’s deep drop into the red.

This month, the CCI for the region’s industrial companies is 41.7; in a slightly worse position than last month’s CCI of 42.3.

Contractions in demand continues to affect output levels for Eurozone manufacturers but the downwards trend may begin to ease in coming months as Europe emerges from lockdown restrictions.

.

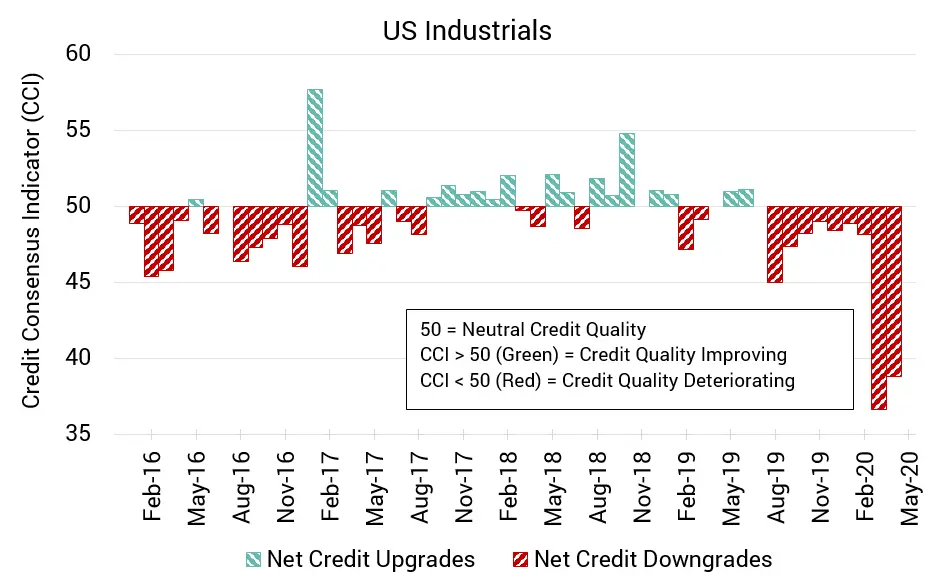

The US Industrials: CCI Sees Scant Relief from Downgrades

The credit quality of US Industrial companies remains largely unchanged from last month’s dramatic downturn.

This month’s CCI sits at 38.8, up from 36.7 last month. It has now been 10 months since an instance of net upgrades in the longer-term trend.

Reports of stabilisation for US manufacturers suggest that while the figures look bad, they are at least moving in the right direction. High levels of unemployment will dampen economic growth for some time though, the effects of which will surely remain felt by the industrial sector. month’s CCI sits at 38.8, up from 36.7 last month. It has now been 10 months since an instance of net upgrades in the longer-term trend.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: